Driving Growth

Since 1995

Crescentia Capital, the successor private equity business of Calvert Street Capital Partners, has been partnering with families and owner-operators to accelerate growth and drive value creation in lower middle-market companies since 1995. We collaborate closely with our management teams, employing a disciplined and focused investment approach that aligns our interests and commitment to the strategic growth plan.

Over the years, the Crescentia has continued to evolve and improve its process and playbook. Today, Crescentia utilizes a three-pillared investment approach that leverages the skills and experience of its investment and operating professionals.

Crescentia Capital is the equity buyout business of Calvert Street Investment Partners.

Download Overview

Crescentia Capital believes that it offers a differentiated opportunity to invest in the lower middle market through its:

Sector Focus:

- Industrial Services

- Infrastructure Services

- Specialty Manufacturing

Thesis-Driven Investment Strategies based on in-house research and collaboration with Industry Advisors to identify sub-sectors with strong tailwinds

Hands-on Value-Creation Playbook led by our Operating Partners and investment professionals designed to accelerate growth

Approach

Crescentia Capital specializes in control equity investments with a keen focus on long-term value creation. Our disciplined and focused approach combines industry expertise, flexible structuring, and playbook to support management teams in executing the value creation plan and ambitious growth objectives. We emphasize management alignment, strategic planning, and operational excellence, fostering a culture of partnership and continuous improvement to build sustainable competitive advantages.

Highlights

Our sector focus and thesis-driven approach is informed by our 30-year history of investing significant capital through economic cycles and the collective experience of our investment professionals and operating resources.

Capital

Investment

Portfolio

For nearly 30 years, Crescentia Capital has developed a disciplined and sector-focused approach to investing in the lower middle market.

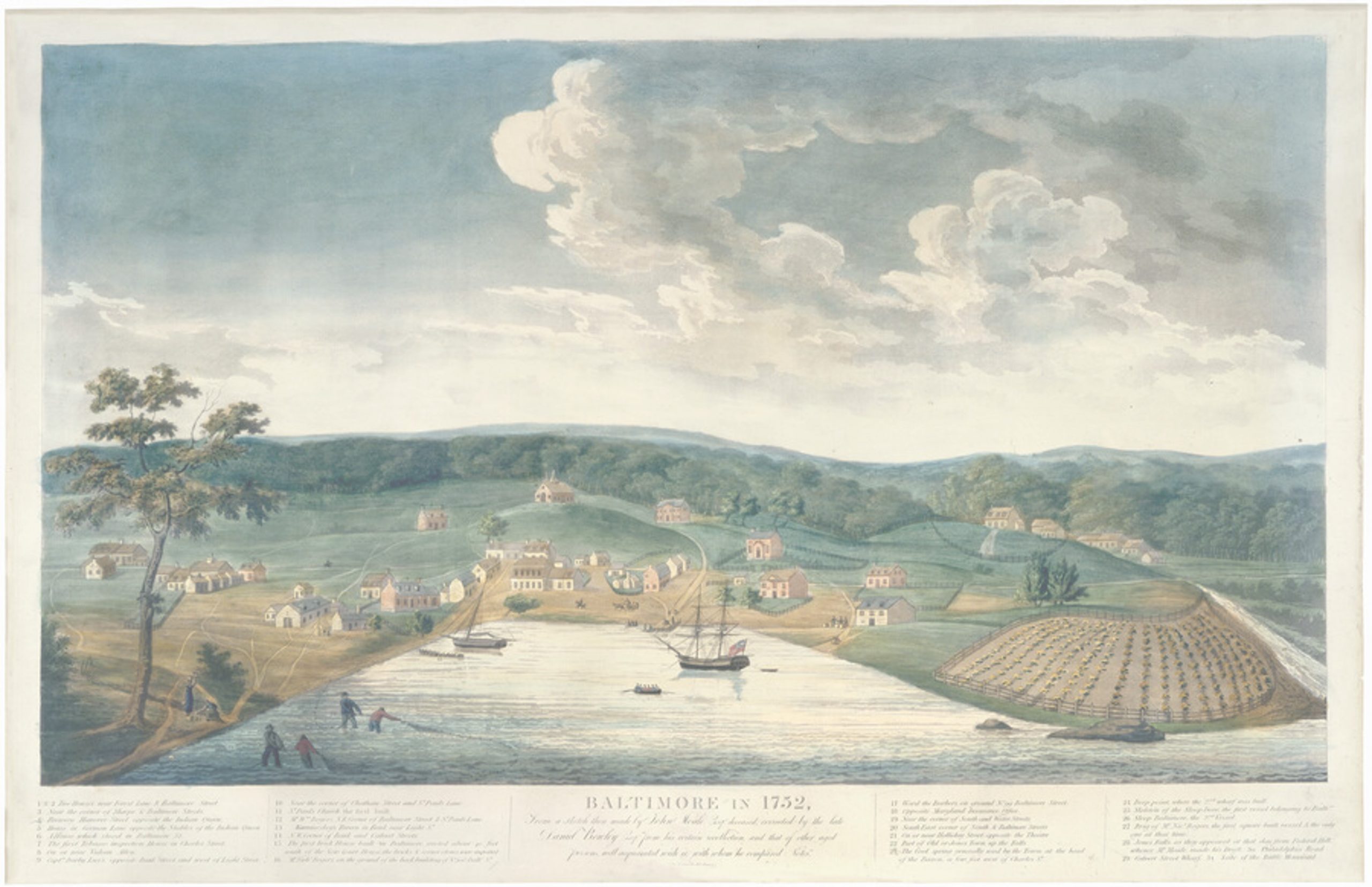

Echoing the Past

Crescentia's Growth-Inspired Name

"Crescentia" means "land of growth or increase" and was the name that Lord Baltimore, Sir George Calvert, originally intended for the land granted to him by King Charles I in the early 17th century. Though the land ultimately became the State of Maryland, in honor of Queen Mary, the essence of growth and potential that Crescentia embodies aligns with our firm’s mission and history at Calvert Street. At Crescentia Capital, we view the lower middle market as the 'land of growth’ and passionately drive our investments to increase value and achieve successful outcomes.